It seems to me that western media are divided. You have, on the one hand, "official" media like DW and BBC that spout the malicious, anti-democratic EU line. You also have, on the other hand, the Guardian with its Athens correspondent, Helena Smith, reporting in a fair manner - to be contrasted with its coverage of Ukraine and Russia.

There is a very important story carried by Reuters (and relayed by Zero Hedge) that the US pressured the release (against the objection of the Europeans) of an internal IMF report backing up Greek contention that the debt is unpayable. This has been reported by the Guardian, but ignored by pro-EU media like the BBC.

In the meantime things are getting very dire for Greece as it moves towards Sunday's referendum.

Greek

economy close to collapse as food and medicine run short

Alexis

Tsipras urges people to vote no in Sunday’s referendum as capital

controls bite and vital tourism industry sees tens of thousands

cancel holidays in Greece

3 July, 2015

Greece’s

economy is on the brink of collapse after the capital controls

imposed ahead of Sunday’s referendum left the country with

shortages of food and drugs, the tourist industry facing a wave of

cancellations and banks with barely enough money to survive the

weekend.

Banks

said they had a €1bn cash buffer to see them through the weekend –

equal to just €90 (£64) a head for the 11 million-strong

population – and would require immediate help from the European

Central Bank on

Monday whatever the result of the referendum, in which the two sides

are running neck and neck.

Alexis

Tsipras,

Greece’s prime minister, was fighting for his political life on

Friday night, using a rally to say that a no vote would enable him to

negotiate a reform-for-debt-relief deal with the country’s credдtors.

The

survival of the Syriza coalition,

formed just over five months ago to repudiate five years of austerity

programmes, was in doubt as Greece started to suffer shortages of

basic provisions, including the sale of vital drugs in pharmacies

nationwide.

Food

staples, such as sugar and flour, were also fast running out on

Friday as consumers started to feel the effect of the restrictions.

“We

have shortages,” said Mary Papadopoulou, who runs a pharmacy in the

picturesque district of Plaka beneath the ancient Acropolis. “We’ve

run out of thyroxine [thyroid treatment] and unless things change

dramatically we’ll be having a lot more shortages next week.”

Greek

islands, where thousands of holidaymakers headed this week, have also

been hit, with popular Cycladic destinations such as Mykonos and

Santorini reporting shortages of basic foodstuffs. More than half of

Greece’s food supplies – and the vast majority of pharmaceuticals

– are imported, but with bank transfers now banned, companies are

unable to pay suppliers.

Queues

were reported at every cash machine in Athens on Friday night and

business groups warned that the economic shutdown in the week since

Tsipras called the referendum had already caused lasting damage to

the economy.

“Imports,

exports, factories, firms, transport – everything is frozen,”

said Vasilis Korkidis, who heads the national Confederation of

Hellenic Commerce. “The only sectors in demand are food and fuel.”

Korkidis

said the economy had suffered losses worth €1.2bn in the past week

and that the cost would have to be added to any fresh bailout deal.

“Even in the best-case scenario, it is going to take months to

recover from the shock of closed banks and capital controls,”

Korkidis said. “Now that they are in place, capital controls may

last for a year.”

Tourism,

the mainstay of the Greek economy and its main export earner, has

seen an estimated 50,000 holidaymakers cancelling bookings every day

since Tsipras walked out of talks in Brussels a week ago. The Greek

Tourism Confederation (SETE) announced that bookings were down by 40%

in the past few days.

The

ECB will meet on Monday to decide whether to step up its help

to Greeceunder

its emergency liquidity assistance scheme. The head of Greece’s

banking association, Louka Katseli, told reporters: “Liquidity is

assured until Monday, thereafter it will depend on the ECB decision.”

Despite

rumours, the Greek government kept the daily limit on cash

withdrawals at €60 (£42) on Friday, gambling that the banks would

have just enough money to cope with demand until the referendum,

which was ruled lawful by Greece’s top administrative court.

Analysts

warned that the yes side – which would be prepared to accept the

terms demanded by the European commission, the ECB and the

International Monetary Fund – would comfortably win if the banks

ran out of cash altogether. Yiannis Dragasakis, the government’s

vice-president, said ATMs were fully supplied with cash before the

weekend.

Wolfang Schäuble, the German finance minister, is depicted on a no poster outside the Bank of Greece in central Athens. Photograph: Alexandros Vlachos/EPA

On

Friday, Tsipras urged Greeks to give him the mandate to negotiate a

better deal, saying that his argument was supported by an IMF

study showing that his country’s debts were unsustainable even on

the rosiest economic assumptions.

“I urge you to say no to ultimatums, blackmail and fear. To say no

to being divided,” Tsipras said. It has emerged that the eurozone

tried to stop the IMF publishing its study.

Huge

crowds – from young students to pensioners with grandchildren in

tow – packed Athens’ Syntagma square, jamming the nearby metro

station and surrounding streets to hear Tsipras address a mammoth no

rally on Friday night.

“I’m

here to shout no at the top of my voice,” said Panos Stathopoulos,

a recently retired dentist. “No to austerity; no to this European

Union that

seems to have no sentiment, nothing.”

Sporting

a red-and-white OXI sticker, Stathopoulos said that after five years

of austerity, “They know the situation very well, and still they

keep trying to impose these measures on the weakest of us – I’m

sorry for the founding fathers of the EU, I don’t think they ever

envisaged a Europe like

this.”

Friends

and colleagues Eri, Constantina and Marta – all psychologists –

said they had come because “we want to have hope.” They would

vote no on Sunday because “we want to be able to express our own

opinions, and to decide for ourselves, in our own country,” said

Eri.

The

yes campaign turned the centre of the open-air – and open-ended –

Panathenaic Stadium in central Athens into a sea of Greek flags

dotted with some EU ones. They also spilled out for about 50 yards

down the avenue that runs across the stadium’s open side.

It

was an altogether more rumbustious – and better-attended –

demonstration than the one on Tuesday in Syntagma Square, which was

marred by rain.

On

Friday night, toting a big EU flag, Dimitris Tsaoussis, a financial

analyst, said he was there to “tell my European family that we

belong in Europe and we will stay in Europe”. Zacharias Sachinis, a

marketing manager with a chemicals firms, who was at the rally with

his wife and son, said he was going to vote yes on Sunday because

“the euro is good for Greece”, even though he didn’t like “the

dictatorship of Schэauble.”

As

on Tuesday, the atmosphere was good-natured. But below the surface

calm there is deep concern – and some trepidation. With the

approach of the referendum, growing numbers of Greeks are becoming

reluctant to give their names to reporters.

“I

came because we can’t be indifferent,” said one young woman

emphatically. But she balked at identifying herself. So did her

friend, who said: “We can’t predict the consequences of anything.

That’s why we’re nervous.”

Polls

have tightened in recent days following warnings from the commission

and Greece’s eurozone partners that a no vote would mean its exit

from the single currency. Support for the yes side is coming

primarily from voters over 55, with all other age groups backing

Tsipras.

An

already tense atmosphere was heightened on Friday after it emerged

that the country’s defence minister had said that the military

could ensure internal security if necessary.

Greece’s

post-war history of military dictatorship meant Panos Kammenos, who

also heads the nationalist, rightwing Independent Greeks party,

caused controversy when he said: “The country’s armed forces

guarantee stability internally, the national sovereignty and the

country’s territorial integrity [and] stability in relation with

the country’s alliances.”

Vicky

Pryce, the Greek-born chief economic adviser at the Centre

for Economics and Business Research,

said: “There has been too much austerity, but a no vote would make

things worse. It would almost certainly mean banks becoming

insolvent, an exit from the euro and a much faster decline in

economic activity with hyperinflation following as the drachma that

is introduced instantly devalues.

“A

yes vote would keep banks open and give a mandate for a deal to be

struck that recognises the new Greek realities and includes, as the

IMF now says, restructuring of the debt which every economist knows

is unsustainable. This would offer some light at the end of the

tunnel. A no vote would make that almost impossible to accomplish and

could plunge Greece into years of economic turmoil.”

The BBC perpetuates the lie that this is a struggle between those who want to stay in the EU and those that don't.

Tens of thousands of Greeks have attended rival rallies in Athens ahead of a crucial referendum on Sunday....

The BBC's Chris Morris in Athens says this has become a choice about whether to stay in the eurozone. With so much at stake, he says, the rhetoric is getting nasty - no-one can even be sure whether Greek banks will be able to reopen next week as the government has promised

From RT.

Just have a look at the video footage below, from the 'no' rally in Athens. It is hard to believe from that there is going to be a 'yes' vote - but then the media barons will all be pushing the EU line.

Two rival rallies took place in Athens on Friday. Police estimate that 25,000 came out to support the ‘No’ camp, which calls for the rejection of a new bailout deal with creditors in Sunday’s referendum, while 20,000 gathered to back the “Yes” vote.

US

Pushed For IMF Greek Haircut Study Release After Euro 'Allies' Tried

To Block

3

July, 2015

The

timing of the

release of The IMF's 'Greece needs a debt haircut no matter what'

report this

week was odd to say the least.

Being as it confirmed everything the Greek government has been saying

and provided the perfect ammunition for Tsipras to spin

Sunday's Greferendum as

a Yes/No to debt haircuts - something everyone can understand (and

get behind). It is understandable then that, as

Reuters reports, Greece's

eurozone allies tried to block the release of the damning report this

week but the

Europeans were heavily outnumbered and the United States, the

strongest voice in the IMF, was in favor of publication,

sources said. While The IMF concluded, "Facts are stubborn. You

can't hide the facts because they may be exploited," one wonders

if this move merely reinforces

Goldman's concpiracy theory.

Euro

zone countries tried in vain to stop the IMF publishing a gloomy

analysis of Greece's debt burden which the leftist government says

vindicates its call to voters to reject bailout terms,

sources familiar with the situation said on Friday. As

Reuters reports,

publication of the draft Debt Sustainability Analysis laid

bare a dispute between Brussels and the Washington-based global

lender that

has been simmering behind closed doors for months

At a meeting on the International Monetary Fund's board on Wednesday, European members questioned the timing of the report which IMF management proposed at short notice releasing three days before Sunday's crucial referendum that may determine the country's future in the euro zone, the sources said.There was no vote but the Europeans were heavily outnumbered and the United States, the strongest voice in the IMF, was in favor of publication, the sources said.The Europeans were also concerned that the report could distract attention from a view they share with the IMF that the Tsipras government, in the five months since it was elected, has wrecked a fragile economy that was just starting to recover."It wasn't an easy decision," an IMF source involved in the debate over publication said. "We are not living in an ivory tower here. But the EU has to understand that not everything can be decided based on their own imperatives."The board had considered all arguments, including the risk that the document would be politicized, but the prevailing view was that all the evidence and figures should be laid out transparently before the referendum.

"Facts are stubborn. You can't hide the facts because they may be exploited," the IMF source said.

*

* *

Quite

simply this should be horrifying to not just The Greeks (who

just discovered their supposed 'allies' tried to hide the truth from

them and in fact negotiated in bad faith) but

to all Europeans who by now must realize the union is not for them,

it is for the few ruling elite and their corporate and banking

overlords.

Isn't

it time to Just Say No, if not to anything else than to being

controlled by an unelected cabal of oligarchs whose only interest is

making sure the wealthy get wealthier?

Of

course, taking a step back from the table, it is clear that a forced

decision by Washington against the interests of its European allies -

that is likely to engender more chaos and strengthen Greece's ability

to destabilize Europe - must have been done for 'another reason'.

Perhaps after all is said and done, the powers that beneed chaos,

need instability, need panic in

order to ensure the public gratefully accept

the all-in QE-fest that they want.

Here is the original Reuters report

And a short piece from Yanis Varoufakis. Please listen to the interview with Yanis below with Bloomberg

IMF backs (ever so peculiarly) the SYRIZA government’s

Yanis

Varoufakis

Debt

relief ought to be at the centre of negotiations over a New Deal for

Greece. That has been our government’s mantra from 26th of

January, our first day on the job. Exactly five months later, on

26th of June, the IMF has conceded the point (as

evidenced earlier today by the NYT) – on the very day Prime

Minister Alexis Tsipras called for a referendum so that the Greek

people could reject an IMF-led proposal that offered no… debt

relief.

The IMF’s

latest debt sustainability analysis (DSA) is a fascinating

read:

For

the first time, the IMF recognised that, in its fifth review

assessment, there was a low probability that Greece’s public debt

would prove sustainable.

Here

is an extract from the IMF’s own report confessing that, to portray

Greek public debt as sustainable (without substantial debt relief),

its researchers had to make the assumption that “…Greece would go

from having the lowest average total factor productivity (TFP) growth

in the euro area since it joined the EU in 1981 to having among the

highest TFP growth, and that it would go to the highest labor force

participation rates and to German employment rates.” Pigs would, of

course, sooner fly!

When

asked how productivity growth would do the ‘pole vault’ from the

euro area’s lowest to the euro area’s highest levels, with

employment recovering fully (and in the absence of credit and

investment), the IMF’s standard answer is: “To achieve TFP growth

that is similar to what has been achieved in other euro area

countries, implementation of structural reforms is therefore

critical.” But, Chapter

3 of the IMF’s April 2015 World Economic Outlook report

tears this assumption to pieces. Indeed, the IMF’s own research

shows that labour market reforms have a negative impact on total

factor productivity while product market reform has a neutral one.

Returning

to Greek public debt sustainability, this latest DSA (debt

sustainability analysis) by the IMF could not be blunter. In fact, it

is even ‘ruder’ to official Europe, that remains in denial of the

need for any debt relief, than we – the SYRIZA government – would

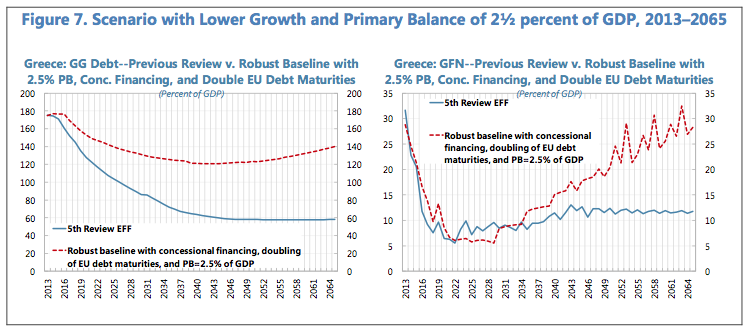

imagine being: Without a haircut, the IMF claims, not even fifty

years of austerity (i.e. a primary surplus of 2.5%) would suffice to

reduce debt to sustainable levels – see graph.

“It

is simply not reasonable”, also argues the IMF’s document “to

expect the large official sector held debt to migrate back onto the

balance sheets of the private sector at rates consistent with debt

sustainability”. Of course it is not![1]

EPILOGUE

Puzzlingly,

all this fine research by the good people at the IMF suddenly

evaporates when IMF functionaries coalesce with their ECB and the

European Commission colleagues in order to impose upon our government

their chosen policies. On 25th June we were presented with their

ultimatum that centred upon zero debt relief, gigantic austerity

(3.5% in the medium term), and more of the same labour and product

markets’ ‘reforms’.

- Never before has a veritable institution advocated policies that clashed so mercilessly with its own research.

- Never before has the IMF agreed, on economic analysis, with a government it sought to devastate.

[1] One

wonders why it migrated to the public sector balance sheet in the

first place. Could it be that this was accomplished by the failed

IMF-driven programs of 2010 and 2012?

This is based on a report from FT that Yanis Varoufakis has dismissed as a "malicious rumour"

Greek

Banks Considering 30% Haircut On Deposits Over €8,000: FT

3 July, 2015

Last

week in "For

Greeks, The Nightmare Is Just Beginning: Here Come The Depositor

Haircuts,"

we warned that a Cyprus-style bail-in of Greek depositors may be

imminent given the acute cash crunch that has brought the Greek

banking sector to its knees and forced the Greek government to

implement capital controls in a futile attempt to stem the flow.

The

depositor "haircut" would be a function of the staggered

ELA haircut that the ECB could impose to escalate the rhetoric

between the two sides, and could take place with as little as a 10%

increase in the ELA collateral haircut from its current 50% level.

Unfortunately for Greeks, the ECB has frozen the ELA cap, meaning that as of last Sunday, Greek banks were no longer able to meet deposit outflows by tapping emergency liquidity from the Bank of Greece.

Now,

with ATM liquidity expected to run out by Monday and with the

country's future in the Eurozone still undecided, it appears as

though Alexis Tsipras' promisethat

"deposits are safe" may be proven wrong.

According

to FT, Greek

banks are considering a

depositor bail-in that could see deposits above €8,000 haircut by

"at least" 30%.

Via FT:

Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears

The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said.

A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers’ funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over €100,000.

It would be implemented as part of a recapitalisation of Greek banks that would be agreed with the country’s creditors — the European Commission, International Monetary Fund and European Central Bank.

“It [the haircut] would take place in the context of an overall restructuring of the bank sector once Greece is back in a bailout programme,” said one person following the issue. “This is not something that is going to happen immediately.”

Greek deposits are guaranteed up to €100,000, in line with EU banking directives, but the country’s deposit insurance fund amounts to only €3bn, which would not be enough to cover demand in case of a bank collapse.

With few deposits over €100,000 left in the banks after six months of capital flight, “it makes sense for the banks to consider imposing a haircut on small depositors as part of a recapitalisation. . . It could even be flagged as a one-off tax,” said one analyst.

Earlier,

via Bloomberg:

Liquidity for Greek bank ATMs after Monday will depend on the ECB decision, National Bank of Greece Chair Louka Katseli tells reporters in Athens.

Meanwhile,

Yanis Varoufakis swears this is nothing but a "malicious rumor":

FT report of a Gk Bank Bail In is a malicious rumour that the Head of the Greek Banks Association denied this morning http://t.co/3xtnQvpS7R

— Yanis Varoufakis (@yanisvaroufakis) July 3, 2015

And

moments ago Bloomberg reported that according to an emailed statement

by the Greek finance ministry, the "FT report on deposits bail

in is outright lie, provocative, and targets undermining July 5

referendum" and as a resultt the "finance

ministry demands Financial Tines to retract report."

The following was a surprisingly good article that appeared in the NZ Herald

The following was a surprisingly good article that appeared in the NZ Herald

Forgiving

debt, if done right, can get an economy back on its feet.

The

International Monetary Fund certainly thinks so, according to a new

report in which it argues Greece should get help.

But

Germany, another major creditor to Greece, is resisting, even though

it should know better than most what debt relief can achieve. After

the hell of World War II, the Federal Republic of Germany "

commonly known as West Germany " got massive help with its debt

from former foes.

Among

its creditors then? Greece.

The

1953 agreement, in which Greece and about 20 other countries

effectively wrote off a large chunk of Germany's loans and

restructured the rest, is a landmark case that shows how effective

debt relief can be. It helped spark what became known as the German

economic miracle.

So

it's perhaps ironic that Germany is now among the countries resisting

Greece's requests for debt relief.....

And for some more recent historical perspective - from 2011

November

01, 2011

Despite

causing turmoil on world markets and the shocked reaction from other

European states, George Papandreou has won the support of the cabinet

after an emergency meeting in which he said the move would pave the

way for Greece staying in the euro.

The

Greek prime minister is now expected to hold talks with President

Nicolas Sarkozy and Chancellor Angela Merkel on Wednesday. But while

the Greek PM has found political support for the highly unpopular

deal, critics argue he is putting both his country’s and Europe’s

futures on the line.

A

Greek deputy’s defection from the ruling party is only the latest

consequence of Prime Minister George Papandreou’s decision to hold

a surprise referendum on last week’s Greek bailout package

And from the author of "Confessions of an Economic Hitman", John Perkins

And from the author of "Confessions of an Economic Hitman", John Perkins

“Greece

is being ‘hit’, there’s no doubt about it,” - John Perkins

“Greece

is being ‘hit’, there’s no doubt about it,” exclaims John

Perkins, author of Confessions of an Economic Hit Man, noting that

“[Indebted countries] become servants to what I call the

corporatocracy … today we have a global empire, and it’s not an

American empire. It’s not a national empire… It’s a corporate

empire, and the big corporations rule.”

John

Perkins, author of Confessions of an Economic Hit Man, discusses how

Greece and other eurozone countries have become the new victims of

“economic hit men.”

No comments:

Post a Comment

Note: only a member of this blog may post a comment.