Warning:

I'm no economist.

The

news here is that crude oil prices have declined 51 % since June.

It

seems to me that price messages and geopolitical events should by

right have driven prices back up.

Instead

of that they are falling rapidly - $30 a barrel and below.

This

means, together with all the other indicators (like all commodities

prices), the fall-off in world shipping that there is a major

fall-off in global demand although Saudi's games with Russia may also

have initially played a role.

This

is a rapidly-moving game.

Watch

this space.

Warning:

I'm no economist.

The

news here is that crude oil prices have declined 51 % since June.

It

seems to me that price messages and geopolitical events should by

right have driven prices back up.

Instead

of that they are falling rapidly - $30 a barrel and below.

This

means, together with all the other indicators (like all commodities

prices), the fall-off in world shipping that there is a major

fall-off in global demand although Saudi's games with Russia may also

have initially played a role.

This

is a rapidly-moving game.

Watch

this space.

Tanker Rates Tumble As Last Pillar Of Strength In Oil Market Crashes

13

January, 2015

If

there was one

silver-lining in the oil complex,

it was the demand for VLCCs

(as

huge floating storage facilities or as China scooped up 'cheap' oil

to refill their reserves) which drove tanker rates to record highs.

Now, as Bloomberg notes so eloquently, it appears the party is

over! Daily

rates for benchmark Saudi Arabia-Japan VLCC cargoes have crashed 53%

year-to-date to $50,955 (as

it appears China's record crude imports have ceased).

In

fact the rate crashed 12% today for the 12th straight daily decline

from over $100,000 just a month ago...

China

imported a record amount of crude last year as oil’s lowest annual

average price in more than a decade spurred stockpiling and boosted

demand from independent refiners.

China's

crude imports last month was equivalent to 7.85 million barrels a

day, 6 percent higher than the previous record of 7.4 million in

April, Bloomberg calculations show.

China

has exploited a plunge in crude prices by easing rules to allow

private refiners, known as teapots, to import crude and by boosting

shipments to fill emergency stockpiles. The

nation’s overseas purchases may rise to 370 million metric tons

this year, surpassing estimated U.S. imports of about 363 million

tons, according to Li Li, a research director with ICIS China, an

industry researcher.

But

given the crash in tanker rates - and implicitly demand - that "boom"

appears to be over.

Shipbroker

analysts blame fewer

January cargoes and oil companies using their own vessels for

shipment as

the main reasons for the dramatic decline. As Bloomberg adds,

Oil tanker earnings boomed thanks to the very thing that drove down crude prices: an abundance of supply that made ship-fuel cheaper and shipments plentiful. This month, shipbrokers report a slump in spot cargoes from the Middle East.

While they say it would be premature to suggest that has implications for the region’s output, the plunge in ratesshows just how sensitive owners are to monthly fluctuations in shipments.

The

good news after all this carnage is that, even before today's

plunge, collapsing

tanker rates were already pushing economics for floating storage (the

carry trade) closer to be proditable.

You

have to look for it, but it there. The SMH has live coverage of the

stock market rout -

Markets

Live: Investors rush to the exits

Oil

prices have dropped 51 per cent since June, 2015

The

crude oil rout, which pushed the spot price under $US30 for the first

time in 12 years, may be hurting the producers, but it's

delivering windfall

profits for Australia's four remaining oil refineries.

BP,

ExxonMobil, Caltex and new local player Viva Energy are

enjoying some of the strongest profit margins on refining for years,

in stark contrast to the bloodbathtaking

place in oil and gas production and expectations just 18 months ago.

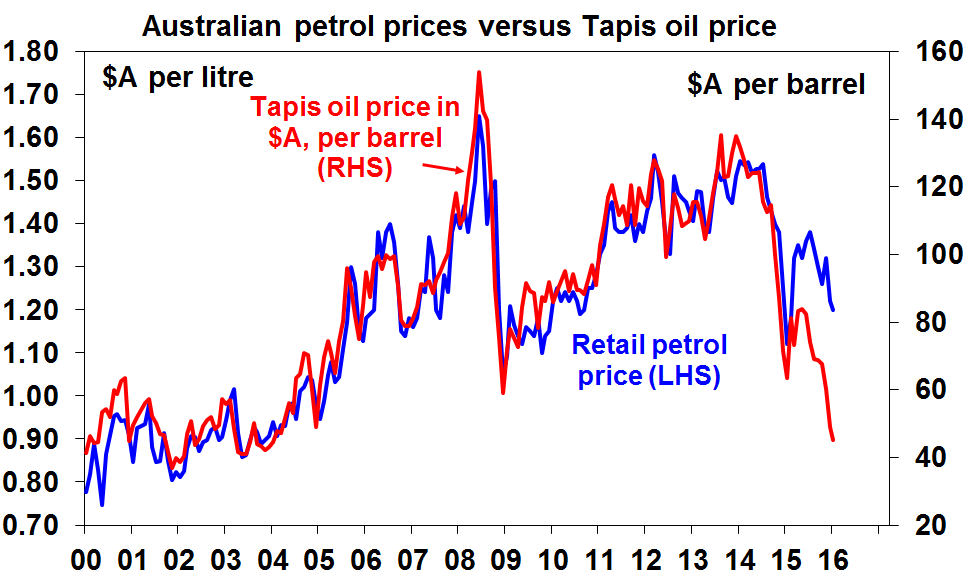

While

crude oil prices have dropped 51 per cent since the end of

June, petrol priceshave

fallen about 15 per cent.

Retail

petrol prices in Sydney fell close to $1

a litre early

this month and have since risen despite the slide in crude oil

prices. Across the country, the price for regular unleaded petrol

averaged $1.22 a litre last week, up 2¢ from the first week of the

year, according to the Australian Institute of Petroleum.

One

of the beneficiaries is a large refinery in Geelong, which

commodities trader Vitol bought from Shell in early 2014 when most

expected the ageing, unprofitable plant to be forced to close. Vitol

owns Viva Energy, which operates the plant.

"Lower

oil prices and lower exchange rates have

overall been good for refining in Australia," Viva chief

executive Scott Wyatt said.

"A

high Australian dollar has been particularly challenging for

manufacturing businesses, so the currency

depreciation over

the last 12 months has certainly been a very welcome relief."

Refining

margins are set in Singapore and local

players have no control

over them. But margins on

retailing petrol and diesel have climbed and

were the highest in the September quarter since at least 2002, the

competition watchdog said last month.

The

findings triggered accusations of price-gouging that were roundly

rejected by the industry, which includes refineries that were

suffering heavy losses until recently.

The

weaker dollar, which traded at US70.13¢ on Wednesday, means the drop

in global crude prices hasn't been fully felt at the petrol pump.

Also, pump prices typically rise sharply when crude prices rise, and

then only show a slow decline as retailers try to undercut their

competitors, industry sources say.

Oil price in $A terms indicates petrol should be near 90 cents/litre. Big rise in refiner margins.See today's AFR p1

Shane Oliver

Shane Oliver

No comments:

Post a Comment

Note: only a member of this blog may post a comment.